|

| Your Road to Financial Solutions |

|

|

|

|

|

GET "WILD ABOUT SAVINGS™" |

New Bicycle Drawing- Two Lucky Youth Members Will Win!

Progressions Credit Union is dedicating the entire month of April to helping youth get “Wild About Savings” by providing information on ways to save and giving goody bags to every new youth account opened. That’s not all! To encourage saving, every youth account member who deposits at least $10.00 will be entered into a drawing to win a NEW bicycle (maximum 1 entry per day). The bikes will be age/size appropriate and will come with a helmet. Click HERE for Official Rules and how to enter.ADDED BONUS: All youth account members between the ages of 0-18 will be automatically entered in a national drawing for a chance to win $100.00 as part of the Credit Union National Youth Savings Challenge! Click HERE for Official Rules.

Learn more about our Youth Accounts HERE.

Not a member? Call us today for more information at 509-535-0191 or APPLY ONLINE.

You can also stay updated on what is happening at Progressions Credit Union by becoming a fan of our Facebook page. |

| |

|

|

|

ATTENTION GRADUATING SENIORS WE ARE OFFERING TWO $500 SCHOLARSHIPS Every year Progressions Credit Union grants two $500.00 scholarships to members who are graduating from high school. If you or someone you know is graduating and could use the help, click HERE to learn more about qualifications and how to apply.

Not yet a member? You can APPLY ONLINE or call us at 509-535-0191 or 800-828-8691 and ask to speak with a Financial Services Representative. |

|

|

SmartLine

Call SmartLine to check balances,transfer funds and review transactions at: (509)-535-8864 or (800)-27-SMART.

SmartLink

Transfer funds-one time, to another member, or set up a recurring transfer, review your account activity, verify when checks clear, get up to the minute balances, view your e-Statements, set up e-Alerts, apply for a loan, open a new account, place a stop payment on a check, send us a secure e mail and more!

SmartPay

Pay your bills with just a few clicks! Pay one at a time or you can set a bill up to be recurring. Set up to receive your bill each month electronically from select merchants. SmartPay also offers Person to Person payments, send a special occasion gift or make a donation to your favorite charity.

SmartMobile

Our mobile app for SmartLink and SmartPay in one easy to use app! Truly the ultimate convenience. Available on iPhone, iPad and Android devices. Download your app HERE. NEW:

SmartDeposit is our new Remote Deposit Capture service! Using the SmartMobile App, take a picture of your check with an iPhone, iPad, or Android device and deposit it in your savings or checking account with Progressions. Learn more and view Frequently Asked Questions.

e-Statements View your monthly or quarterly statements online.

e-Alerts Set up account related or personal alerts to be sent to your phone and/or email.

e-Notices Automatically receive credit union generated notices relating to your account via e mail. Progressions offers all of these convenient services 24/7 FREE of charge!

We provide all of our services using state of the art security to protect your private information. |

|

|

Balance Transfers As Low As 3.99*

The Progressions Visa Classic credit card provides the ultimate in purchasing convenience.With a low rate, 25 day grace period on purchases, no fees for cash advances, and now a low balance transfer rate with no balance transfer fee, you’ll find this card can save you money!Other great features are:

• Auto Rental Collision Damage Waiver

• Emergency Card Replacement & Emergency Cash Disbursement

• Zero Liability**

• Verified by Visa- provides additional protection for online shopping. Protects your Visa card number with a personal password, giving you reassurance that only you can use your Visa card online.

• Worldwide acceptance

• Online access so you can check your balance, make payments and more!

APPLY ONLINE, by phone or in person, today!*APR=Annual Percentage Rate. Rate only applies to the amount transferred and is good for 12 billing cycles. Minimum Equifax Beacon Score (“credit score”) to qualify for promotion is 640. Borrowers with credit scores of 639 or below do not qualify for this promotional rate and will receive standard rate. For balance transfers made before or after the promotional period, your APR will be 9.99% -17.99% based on your credit score as stated in the cardholder agreement. Promotional period is 01/01/2015 through 12/31/2015 and is subject to change. Existing balances on Progressions Credit Union loans, credit cards or lines of credit do not qualify for this offer. See full disclosures at www.progressionscu.org .** Visa’s Zero Liability Policy does not apply to ATM transactions, or to PIN transactions not processed by Visa, or if you were grossly negligent or fraudulent in the handling of your card. |

|

|

|

|

|

Our annual meeting will be held on Tuesday, April 28th, 2015 at 5:30 PM, at our main branch located at 2919 East Mission Avenue. This is a great opportunity to discuss the future direction of the Credit Union and catch up with staff and other credit union members. Snacks and beverages will be provided, along with cash door prizes and other various gifts. The 2015 Board of Directors and Supervisory Committee Election results will also be announced.

HOPE TO SEE YOU THERE! |

|

|

|

Dionne has been working as a Teller at Progressions for 4 1/2 years. When not working she has her hands full with two children, two dogs, one cat and four chickens. She also enjoys camping! Dionne has been working as a Teller at Progressions for 4 1/2 years. When not working she has her hands full with two children, two dogs, one cat and four chickens. She also enjoys camping! |

GET MORE THIS YEAR FROM TURBO TAX |

- All you need to know is yourself. TurboTax translates taxes into simple questions about your life and puts everything in the right forms for you.

- You won’t miss a thing. TurboTax searches over 350 deductions and credits, so you can be confident you’re getting the biggest refund you deserve.

- Double checks as you go. TurboTax runs error checks and a final review of your return to help make sure your taxes are done right.

Start TurboTax now for free

|

|

MESSAGE FROM JONNA DAMIANO AT LPL |

National Retirement Planning Week® 2015:

Jonna Damiano Joins Effort to Promote

Retirement Planning

Note: This section of our eNews contains links to third party web links. When you click these link, you will leave our credit union’s website and will go to a website that is not controlled by or affiliated with our credit union. We have provided these link for your convenience. However, we do not endorse or guarantee any products or services you may view on other websites. Other websites may not follow the same privacy policies and security procedures that our credit union does so please review their policies and procedures carefully.

Jonna Damiano – LPL Financial is proud to announce that it will be supporting National Retirement Planning Week® 2015 – a national effort to encourage Americans to plan for their financial needs in retirement. National Retirement Planning Week® 2015 will take place from April 13 to 17.

The week is organized by the National Retirement Planning Coalition – a group of prominent education, consumer advocacy and financial services organizations, which recognize that the need to help Americans plan for retirement is an ongoing effort. The coalition, spearheaded by the Insured Retirement Institute, is committed to educating Americans about the importance of retirement planning and is determined to make this a national priority.

National Retirement Planning Week® and other coalition activities will demonstrate that – despite developing trends that have made planning for and funding retirement more difficult – it is still possible to “Retire On Your Terms” if comprehensive retirement plans are properly developed and managed. To support these educational and awareness efforts, the coalition maintains www.RetireOnYourTerms.org, which features resources and tools to help Americans focus on their long-term financial goals.

Throughout National Retirement Planning Week®, educational materials will be made available in conjunction with the week’s agenda, and the coalition will encourage retirement planning through nationally distributed print, television and radio materials, a coordinated media outreach program, and events throughout the week.

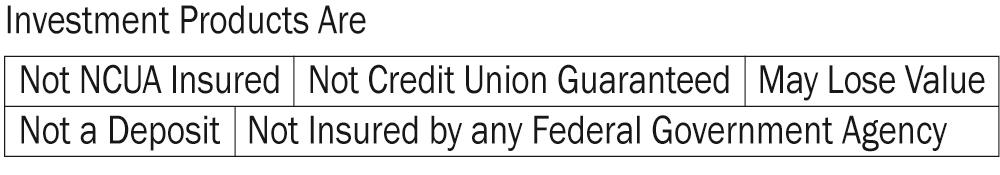

Securities offered through LPL Financial, member FINRA/SIPC. Insurance products offered through LPL Financial or its licensed affiliates. Progressions Credit Union is not a registered broker/dealer and is not affiliated with LPL Financial. Progressions Credit Union, Member Investment Services and National Retirement coalition is not affiliated with LPL Financial. |

|

|

|

Monday, May 25

Memorial Day

Monday, September 7

Labor Day

Monday, October 12

Columbus Day

Wednesday, November 11

Veterans Day

Thursday, November 26

Thanksgiving Day

Thursday, December 24

Christmas Eve (Closed at Noon)

Friday, December 25

Christmas Day

|

|

PHONE

509-535-0191

800-828-8691

SMARTLINE

509-535-8864

800-27-SMART

|

| |

|

Your savings federally insured to at least $250,000 and backed by the full faith and credit of the

United States Government |

|

Our Privacy Policy is available online HERE, or you may request a paper copy by calling us at 509-535-0191 or 800-828-8691. |

|